The Worthiness of Blockchain Technology to Financial Institutions

Every financial institution is searching for ways to stay current and keep up with the changing marketplace. Even though newer companies are entering the market, incumbent organizations are still trying to figure out how to stay relevant in this constantly changing terrain. Banks, for example, need to utilize Cryptocurrencies and blockchain technology because it seems like a strange reason to do so.

These new technologies will help them keep ahead of the curve in this fast-moving industry. If they don’t, they will fall behind. What is driving this adoption? And why should banks adopt these technologies? Let’s take a look at the risks and benefits of adoption. There are several reasons why financial institutions should adopt cryptocurrency technology:

It’s Proven Effective.

Because it has been shown to work, banks must embrace Cryptocurrencies and blockchain technology to stay ahead of the curve. This new technology will help your institution stay ahead of the curve as the market evolves. As the market changes, you must keep up. If you don’t, you will lose competitiveness.

In a world that is ever-evolving, these new technologies will help banks remain business-up-to-date and relevant in a changing world. Customers are more likely to use a bank that has cryptocurrency features than one that doesn’t, according to a study. This is because it makes your company ahead of its rivals, who haven’t yet adopted this new technology.

It’s safer than centralized exchanges.

It is safer to adopt than centralized exchanges. One of the most significant risks associated with centralized exchanges is the high risks involved in storing cash and personal information in a central location. Centralized exchanges must store cash and personal information in a central location, which can make them vulnerable to hacks or breaches.

For the majority of financial institutions, these risks are too significant and they have concluded to use decentralized exchanges like Biti Codes instead. Banks can reduce their risk in this way by adopting Cryptocurrencies and blockchain technology and also increase security by using encryption and cryptography.

It’s simple and fast to use.

Because banks play a role in the world, they have to keep up with technological changes. Cryptocurrencies and blockchain are two examples of what will help banks stay competitive.

Blockchain technology is extremely efficient because it eliminates third-party verification. It’s simple because it doesn’t require third-party verification. As transactions are recorded in “blocks” and not individual transactions, the procedure is significantly quicker than with traditional techniques.

Blockchain technologies, in addition to being easier to employ, also offer greater potential for success. More banks are utilizing blockchain technologies to execute future operations. It also saves time and resources to convert one currency into another as required, which makes automating cryptocurrency transactions easier.

Why It’s Right for Banks to Adopt Blockchain Technology.

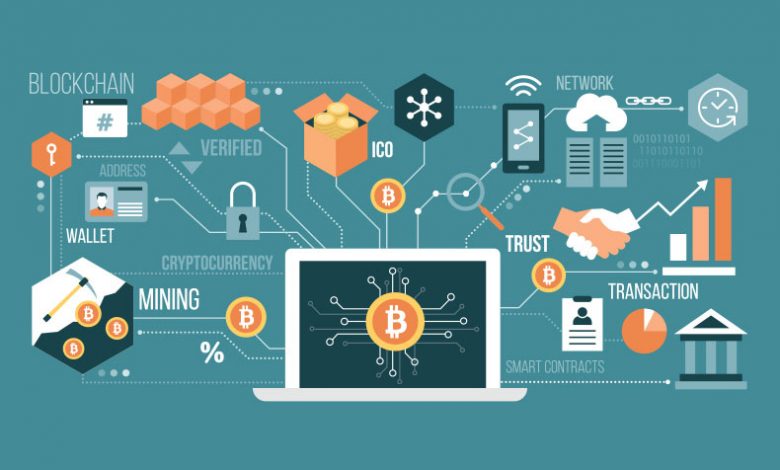

Blockchain technology is a type of distributed ledger that provides many advantages. An immutable record of transactions is created on the blockchain. There is no single point of failure and information cannot be tampered with. It is impossible to delete, hack, or corrupt data on the blockchain. Blockchain technology can process more than 1,000 transactions per second compared to just seven transactions per second for Visa.

As if all of this weren’t enough, blockchain technology is also cheaper than current methods. Because there are no transaction fees on the blockchain, transfers become more affordable while still being secure and fast. The blockchain is a distributed ledger that anyone can view at any time to see if a transaction has been recorded. This is not the case with conventional banks today!

Conclusion

There are several financial advantages to adopting cryptocurrencies and blockchain technology, as we’ve seen. Customer service is one of them. Regardless of the reason, banks must begin to consider how these new technologies can help them provide better services to their customers. If they don’t adopt these technologies soon, they will find themselves well behind the curve.