Fintech’s Impact in the Digital Age

In a fast-paced world of digital transformation, nothing is more important than staying relevant and keeping pace with emerging innovations. Customer expectations have changed, and they are demanding more seamless experiences across all channels. Organizations need to respond faster and more proactively in this digitally driven world, while also keeping a tight rein on costs. This is where data science and fintech come into play.

Defining Fintech

A common definition of fintech is “financial services undertaken via technology.” However, a more accurate description would be “businesses that use software to provide financial services.” The fintech movement has exploded in recent years, partly due to the rise of incubators, accelerators, data scientists, and investment in startups that are focused on creating new products and services for the financial sector. Top business consultants such as Cane Bay Partners have been emphasizing the importance of fintech for quite some time.

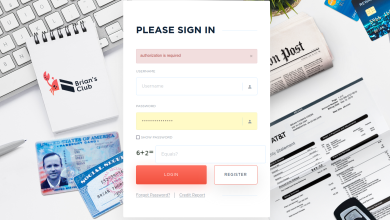

Solving Fraud

As the data scientist is all about numbers and data, it’s not surprising that one of the biggest areas of focus is fraud prevention. Fraud is a huge cost for banks and a major source of customer dissatisfaction. Piling on the pressures, compliance requirements are increasing, and banks must protect customer data and privacy. While fraud detection has long been a part of the banking industry, banks are now turning to data science to make processes more secure. Data scientists employ a variety of algorithms and analytical techniques to help banks identify patterns of fraudulent behavior faster, and respond more quickly.

Artificial Intelligence

Another promising area of fintech that is set to grow is the use of artificial intelligence (AI). Many businesses are turning to AI to help them manage vast quantities of data. Banks collect a lot of data, but much of it is not easily searchable or accessible. AI can help to bring this dark data to light, using machine learning to discover new insights and patterns that can be used for a variety of different purposes. Banks are particularly interested in using AI to help them become more proactive with their clients. AI can be used to gauge customers’ sentiment based on their social media activity and other online indicators, which can help banks respond faster to issues and concerns.

Philanthropy

With the rise of fintech, there’s also been a rise in people using new financial technologies to help others. Online crowdfunding platforms allow people to set up fundraising campaigns to raise money for causes that matter to them. On top of this, technology has made it easier for programs such as Cane Bay Cares to make a difference. Similarly, there are now services that allow people to make international money transfers that are cheaper than traditional providers, and people can even circumvent banks by managing their donations through digital apps.

Fintech has come a long way since its humble beginnings as a few startups in the 1990s. Today, the movement has exploded into a huge industry with new innovations and technologies emerging regularly. It’s worth keeping an eye out for other new technologies that could have just as much impact.

For more valuable information visit this website